Four Principals for DIY Investing

Too many people think all financial advisors, funds, portfolio managers are the same. They are not. There are good funds and bad funds, good managers and bad managers. Just like in school there were those that received A's and those that received F's. If you needed a study buddy to pass an end-of-year exam, you would choose to study with the A student, not the F student. The same is true with anything. The reason graduates from ivy league colleges make tend to make more throughout their life than those from state colleges is because the ivy colleges select the very top students. If you want to experience higher than normal returns, pick winners, not losers.

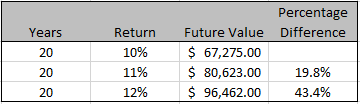

When picking winners, small advantages make big long term differences. Take the following example. If $10,000 were invested over twenty years at the typical S&P 500 return of 10%, then the total balance would be a little over $67,000. However, if an investor were able to eek out just a single percentage point advantage over the S&P 500, then the future value would be over $80,000. That is a 19.8% increase. And, if a two percentage point advantage were realized, then the future value would be over $96,000 or an increase of 43.4%. You don't have to be a market guru to make a lot more money than average. You only have to be slightly above average. My personal goal is to beat the S&P 500 by two percentage points over time. Every additional percentage point above two is gravy.

Here are a few simple principals that anyone can use to improve their personal investments.

Principal 1: Trust no one. Do your own research.

Understand the Market

Part of doing your homework is knowing where the best returns are in the market. Take a look at the illustration below taken from morningstar.com. Over the last five years large growth and mid growth stocks returns have been carrying the stock market. Take advantage of such knowledge by investing in large growth. . . . in moderation.

|

| https://www.morningstar.com/markets |

In the past, small growth stocks have beat large growth and there have been times when large value beat large growth. In the eighties, it was smart to invest in bonds that produced returns in the high teens. These cycles take time to develop and do not change overnight so there is no reason to fear missing the next cycle. When the trend begins to give way to other types of stocks it will become evident and there will be plenty of time to re-adjust.

This is not to say that a smart investment philosophy would be to invest all of your money into large growth stocks/funds. Such a strategy could be very dangerous. What I am saying is that as you monitor market trends, don't be afraid to allocate a little bit more in the clear over-performers.

Assessing market cap stocks is only one way of determining where you should allocate your investments. Another way of looking at the market is by sector. A market sector breaks all stocks into categories regardless of their market cap (small, mid, large) or style (value, core, growth).

The table below shows the cumulative returns for each market sector as well as the five year annualized returns. Information technology has been the clear winner over the last five years, beating other sectors by a wide margin. You can find high performing mutual funds and ETFs for any of these sectors just as you can for any market cap or style.

The biggest takeaway from charts like these is to find what the long term trends are in the market and also to determine where to limit your exposure. For instance, the energy sector and the small growth areas are both areas where you may still want to invest something, but very judiciously, while large growth and information technology may be areas to add a little extra.

Find the Winners

Nobody cares about your money like you do. You can easily beat the average by putting in a little bit of extra work. Most money managers, financial advisors, and portfolio managers do worse than the market average. If you are going to blindly trust a financial advisor to invest your money, you would be safer by just buying a broad market index fund.

There are almost 557 mutual funds to choose from on Fidelity.com for large growth stocks. These funds together represent 2.9 trillion dollars under management. A full 41.9% of all of those assets are under-performing the general market for large growth stocks. That number doesn't even factor in the added cost of expense fees or commissions. Once you factor in operating costs and commissions, more than 50% of all assets are doing worse than just buying a passive large growth index fund.

But that doesn't mean there aren't mutual funds worth buying. The chart below shows the distribution of mutual funds based on their 5 year returns. At least 13 of the 557 available funds beat the average return by 50% or more. And one mutual fund almost beat the average return by 100% (Morgan Stanley Insight Fund Class A - CPOAX). There is no guarantee that the Morgan Stanley Insight Fund will remain at the top of the mountain or can maintain such incredible returns forever. But that is not the point. The point is that if you want to beat the market, there are plenty of good options that significantly out-perform. Any of the top 13 would be great choices to invest in. But doing some of your own research is required. There are many free websites that allow you to search and sort mutual funds or ETFs (fidelity.com, morningstar.com, finance.yahoo.com).

Principal 2: You can't be a part time market genius.

I like to study the market, but since I already have a full time job, I simply don't have the time to do the kind of research required to consistently pick winning stocks. There are simply too many businesses and too many variables to assess. And I don't have a group of analysts that I can direct to analyze a company and their financial outlooks. Therefore, I don't try to be something I know I can't do at a high level. Instead, I spend my time finding the funds, ETFs, and portfolio managers that are in the top 5% for their areas.

Here is my suggestion: Don't be a stock picker. If you are guessing or have a hunch that a company is going to do well, you are on balance going to be wrong. Financial analysts do an incredible amount of research and calculations to try to find winners and they are often wrong. If you are not a financial analyst and don't have the time they have to spend on research, don't assume you can beat those who invest for a living. Instead, piggy back on the top 5% of experts. Find those mutual funds, ETFs and portfolio managers that outperform at a top level across ten, five, and three year increments and invest in them.

Principal 3: Pick multiple winners.

There is no rule that says all of your money has to be in one single mutual fund or in one single sector or market cap. Find winners throughout the various sectors and market caps. I will spread the money I allocated for any given sector or market cap across two or three mutual funds. This way if one fund struggles for a time, the other two are likely to remain strong. That is the point of diversity, don't put all your eggs in one basket. It is plausible that one portfolio manager's strategy was perfect for the last ten years, but will be mediocre for the next ten years. That is unlikely, but possible. Therefore, split up your money across a few different funds. Here are a few options:

The funds listed below are large growth mutual funds that are in the top 5% for returns across three, five, and ten year time-spans. These funds all require no more than a $2,500 initial investment. The average 5-year return for these funds is 24.15%. The average of all large growth stocks over the same time period was 14.85%. There is zero guarantee that these mutual funds will continue to perform at this level. But given the track record, there is a strong possibility that these particular funds will continue to produce above average returns for some time.

2. Morgan Stanley Institutional Fund, Inc. Growth Portfolio Class A (MSEGX) & Class C (MSGUX)1. Morgan Stanley Insight Fund Class A (CPOAX) & Class C (MSCMX)

3. Transamerica Capital Growth Fund Class A (IALAX) & Class C(ILLLX)

4. Virtus Zevenbergen Innovative Growth Stock Fund Class A (SAGAX)

5. Morgan Stanley Institutional Fund, Inc. Advantage Portfolio Class A (MAPPX)6. Franklin DynaTech Fund Class A (FKDNX)

Principal 4: Be patient.

It is unrealistic to expect any mutual fund or actively managed ETF to produce exceptional returns all the time. Sometimes the overall market drops. Mutual funds and ETFs will drop as well. The key is to pay careful attention to how the fund is performing based on its benchmark. But this needs to be analyzed over a longer period of time such as years. In any given month, a fund you have identified as high-performing, may actually be under-performing. This is not a good reason to dump the fund. Patience is required. Good funds will adjust. They have a positive track record for a reason. Constantly putting money into funds and taking money out of funds is a sure-fire way to lose money in the long term. Nobody can predict the market. It will go down unexpectedly and it will go up unexpectedly. If you try to time the market you will lose. Every time.

Once you settle on some good mutual funds or ETFs, stick with them over the long term. At least once a year assess their performance. If they have dropped a little but are still outperforming their benchmark, no reason to panic. Only when the fund has dropped out of the top 5% over a long period of time might it be worth it to re-allocate some of the investment to other top-rated funds.

Comments

Post a Comment